installment open end credit example

A fixed rate mortgage d. Her monthly payment will be 200 7200 36 200.

Credit Scoring Fico Vantagescore Other Models

For instance a lender approves a 50000 line of credit and the borrower withdraws 30000.

. You take 10000 on an open-end loan. Credit cards are the best examples of open-end credit mostly unsecured. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods.

An example of an installment loan would be a car loan you are required to pay a set amount of money at a recurring interval ex. A buy down c. A loan can be closed-end or open-end.

Edwardo Hauck I Last update. 280 per month until the loan is paid off in full. Open-end credit examples Home equity lines of credit or HELOCs.

By applying for a credit card you are applying to be pre-approved for a certain amount of credit credit limit allowing you to use that credit as you need it. An agreement or contract lists the repayment terms such as the number of payments the payment amount and how much the credit will cost. A good example of an open-end credit is A the use of a bank credit card to make a purchase.

In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. Service station credit cards. With an open-end credit the borrower has access to the whole credit limit or full amount once approved.

Installment Loans and Open-End Credit Mindie Hunsaker is thinking about buying a car and getting a 3-year loan from her bank in the amount of 7200. The acquisition of a closed-end credit is a solid indicator of the borrowers good credit rating. With open-end loans like credit cards 1.

An example of open-end credit is aautomobile loans binstallment sales credit cmortgage loans drevolving check credit 11. Bank-issued credit cards. T or F A True B False 2 Suppose you get a 775 installment loan and are charged a.

An open-ended loan example is your credit card. The payments to be made will therefore be 30000 plus interest without having to repay the 20000 remaining in the account unless the same is utilized for something. An FHA mortgage b.

The issuing bank. Department store credit cards. An open ended credit is something like a pre-approved loan where you can use the credit repeatedly over time.

Examples of installment loans include auto loans mortgage loans personal loans and student loans. On the other hand a home equity line of credit HELOC is a secured type of open-end credit. You use 8000 of it repay 5000 of it in the next couple of months 21.

For example your credit limit could increase if your credit rating improves or decrease if the lender views you as a higher risk than when you applied. Other examples include mortgages student loans and term loans. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit.

An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans. Unlike closed-end credit an open-end credit can be used for your frequent and unexpected financial needs and not necessarily for a specific purpose. An open-end loan is a revolving line of credit issued by a lender or financial institution.

Lets give an example of an open-end loan. 495 69 votes Mortgage loans and automobile loans are examples of closed-end credit. For example if an open-end credit account ceases to be exempt A closed-end loan is exempt under 10263b unless the extension of credit is secured 22.

Benefits And Drawbacks of Open End Credit Benefits. What Is Open-End Credit. A fixed rate mortgage d.

By taking out a personal loan which is installment credit and using those funds to pay down your revolving credit outstanding balances. Which of the following is an example of a conventional mortgage. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment payments on a predetermined schedule.

For more information see revolver debt versus installments. An auto loan is an example of this. Finally interest rates tend to be higher on open end credit similar to credit cards and personal lines of credit because there is.

Closed-end credit is a loan or credit agreement signed by a lender and a borrower that includes information regarding the amount borrowed interest rates and charges and monthly payments payable depending on the borrowers credit rating. If you take out an installment loan such as an auto loan this is a form of closed-end credit with a fixed interest rate and payment.

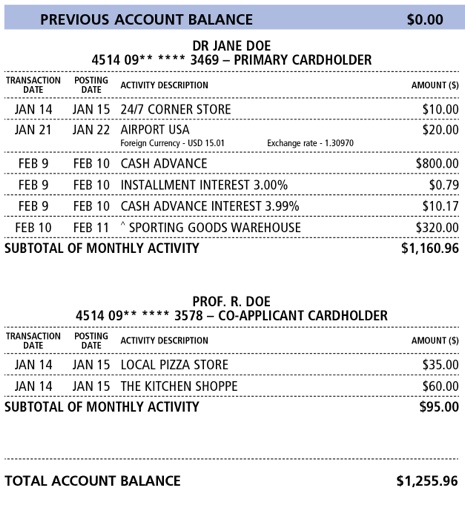

How To Read Your Credit Card Statement Rbc Royal Bank

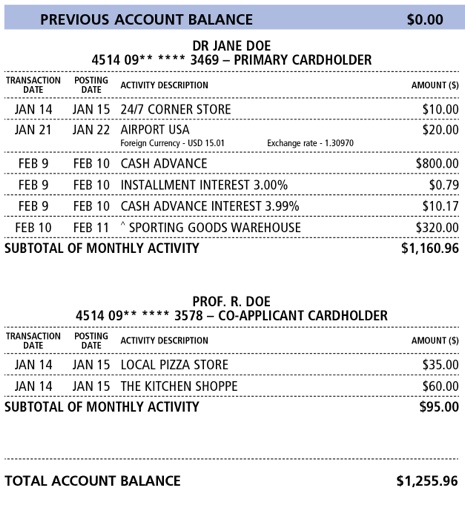

Credit Report Example How To Read And Understand Yours Self

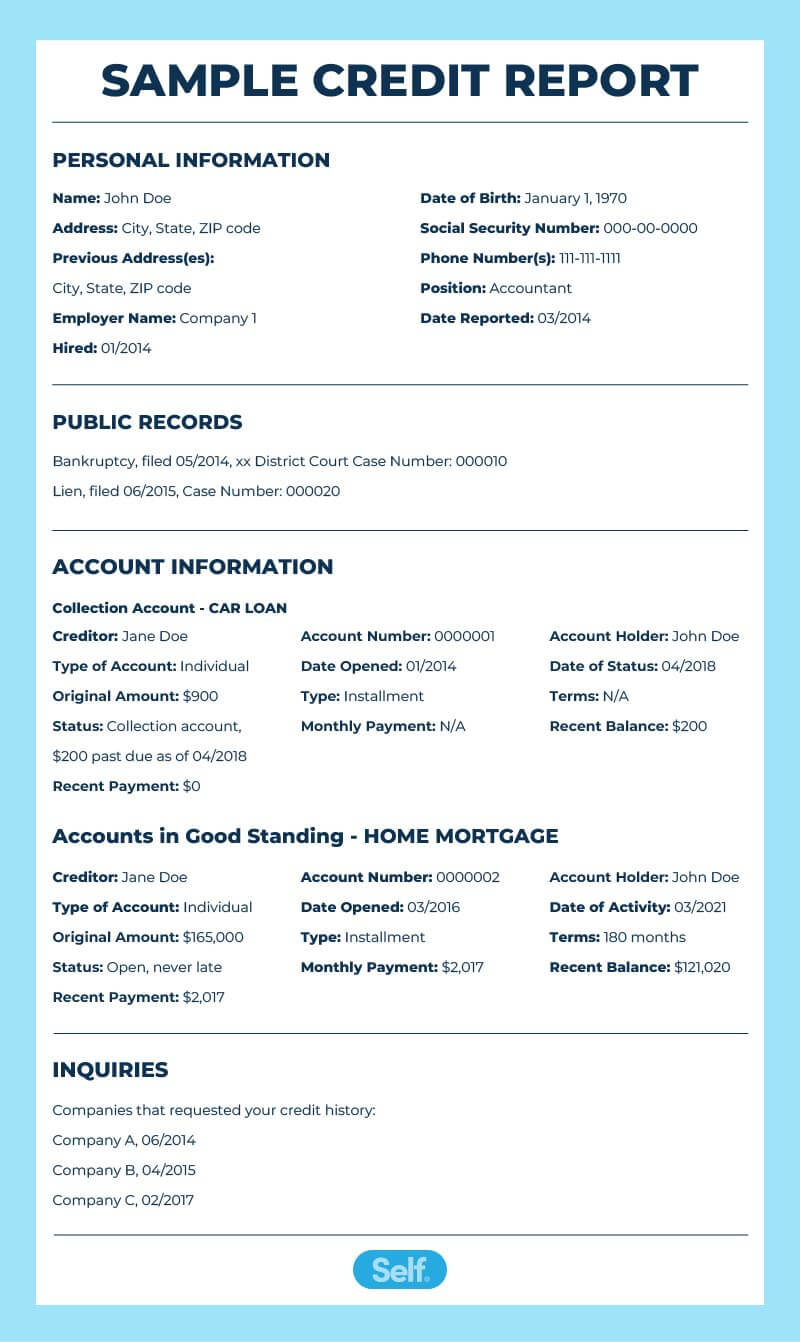

Understanding Different Types Of Credit Nextadvisor With Time

Understanding Different Types Of Credit Nextadvisor With Time

How To Read Your Credit Card Statement Rbc Royal Bank

Revolving Credit Personal Credit Loans Lines Of Credit

What Is Revolving Credit Examples Score Impact More

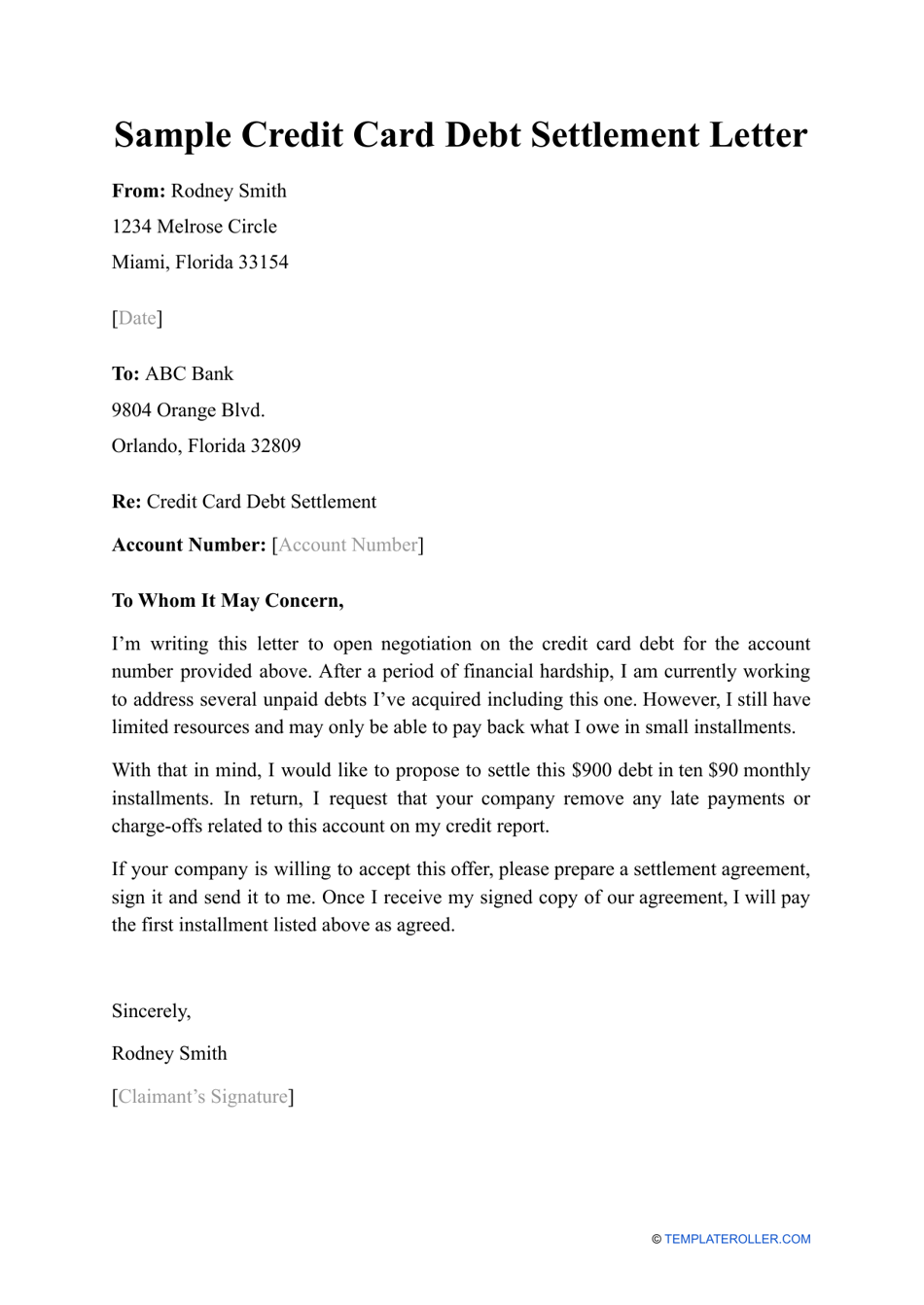

Sample Credit Card Debt Settlement Letter Download Printable Pdf Templateroller

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

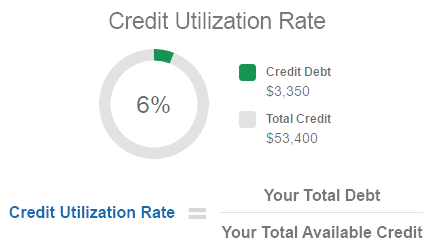

What Is A Credit Utilization Rate Experian

What Are Three Types Of Consumer Credit

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Understanding Your Credit Report Consolidated Credit Canada

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Is Open End Credit Experian

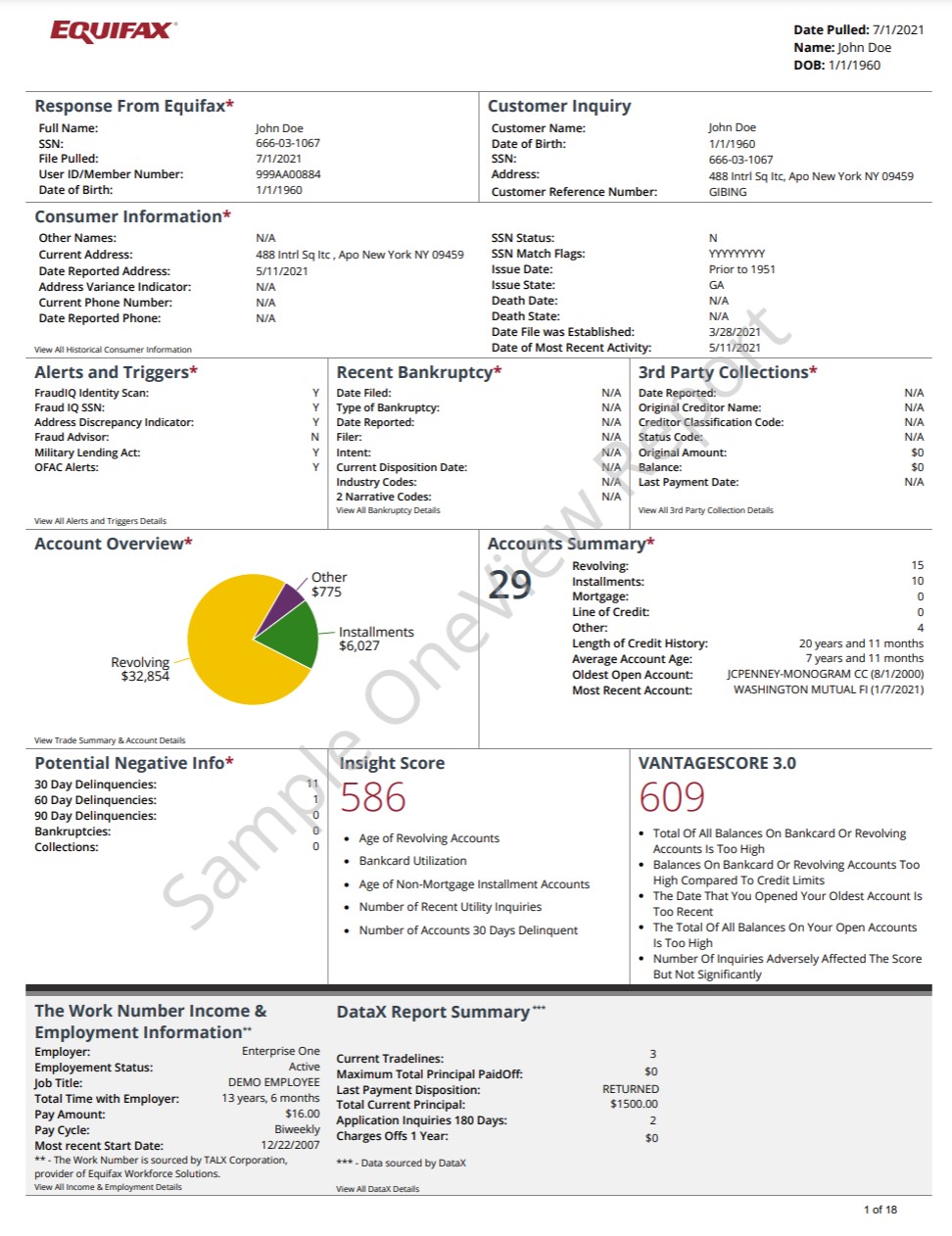

Sample Oneview Report By Equifax Equifax

Credit The Four Most Common Forms Christian Credit Counselors

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)